第八章 The curse of inflation 通胀的诅咒

Even a very moderate degree of inflation is dangerous because it ties the hands of those responsible for policy by creating a situation in which, every time a problem arises, a little more inflation seems the only easy way out.

Friedrich Hayek (1960). The Constitution of Liberty. In Ronald Hamowy (ed.), The Constitution of Liberty, XVII (Liberty Fund Library, 2011): 465.

即使程度非常温和的通货膨胀也是危险的,因为它通过制造一种局面而束缚了那些负责政策的政治家的手脚,在该局面下,每当出现一个问题,再增多一点通货膨胀似乎是唯一简便的出路。(《自由宪章》,第二十一章,哈耶克)

***

Inflation is a decline in money’s purchasing power. Inflation’s most visible consequence is steadily rising prices of all or most goods and services in the economy. For a unit of money (say, a dollar) to lose purchasing power is for that unit of money to lose value. And when a unit of money loses value, it takes more units of that money to buy goods and services. In other words, the prices of goods and services bought with that money rise.

通货膨胀是货币购买力的贬值。它最容易观察到的后果是经济体里所有东西都在不断地涨价。一单位货币(比如一美元)失去购买力指的是它失去了价值。当单位货币失去价值时,人们就需要更多单位的货币来购买商品和服务。换句话说,用该种货币衡量的物价上升了。

By far the most common cause of inflation is an increase in the supply of money. Just as the value of diamonds would fall if a freak meteorological event caused the skies to rain down genuine diamonds, the value of money falls when a nation’s monetary authority increases the supply of that nation’s money. Just as a rainstorm of diamonds would cause people who are willing to sell things in exchange for diamonds to demand more diamonds from buyers, an increase in the supply of money by the monetary authority causes people who are willing to sell things in exchange for dollars to demand more dollars from buyers.

至今最常见的通胀原因是货币供应的增加。就像如果反常天气导致天上下了场钻石雨,钻石的价值就会下降,如果国家的货币当局增加货币供应,货币的价值就会下降。就像钻石雨会让想以商品交换钻石的人要求买家用更多钻石支付,货币供应的增加会让卖家要求买家支付更多的货币。

The cause of inflation, therefore, is quite simple: excessive growth in the supply of money. Stopping inflation is likewise simple: quit injecting newly created money into the economy. But while stopping inflation is easy in principle (no complex theories must be mastered, and no intricate mathematical problems must be solved), it is often very difficult to stop in practice. The reason is that control of the money supply is in the hands of government officials. Stopping inflation is made difficult by politics, not least because it is politics that usually is to blame for starting inflation in the first place.

因此通胀的原因很简单,就是过多的货币供应。停止通胀的做法也很简单:停止像经济体注入新货币。不过虽然这事原则上很简单(不需要精通复杂的理论,也不需要解决复杂的数学问题),但实际上做起来经常很困难。原因在于货币供应的控制权掌握在政府官员手中。停止通胀的困难在于政治,难处之一是通胀往往最初就是由政客发起的,但还不止于此。

Since the demise of the gold standard in the twentieth century, governments have issued “fiat” money. Fiat money is money backed by nothing other than faith in the government that issues it. A government that issues fiat money will redeem units of that money only for other units of that money. The European Central Bank, for example, will redeem 20 euros only for 20 other euros. No gold, no silver, no anything other than itself backs fiat money.

随着金本位于上世纪废除,政府开始发行法币。法币指的是仅仅由政府信誉支撑的货币。发行法币的政府只会把一些法币兑换成另一些面额不同但总额相同的法币。例如欧洲央行只可能把一张20欧元的钞票兑换成20张一欧元的,它不会给你换成金子、白银或者其他任何东西。

One result of fiat money is to tempt government to finance some, and sometimes much, of its expenditures by creating money out of thin air. Because voters frequently and immediately resist having their taxes raised by enough to support every project that government officials want to fund — and because voters typically don’t see the ill-effects of newly created money until much later — government officials often succumb to the temptation to pay for some of their preferred projects with newly created money.

法币的一个结果是它诱惑着政府通过凭空创造货币来支付部分,有时候是很大一部分,政府开销。因为选民经常毫不犹豫地拒绝政府为了支持某些项目而进行的增税,而且选民一般无法立刻看出凭空创造货币的恶果,所以政府官员常常无法抵御通过创造货币来支持他们喜欢的项目的诱惑。

As we saw in the previous chapter, however, money creation by government can cause serious problems down the road. The process of injecting newly created money into the economy can distort the pattern of relative prices and, hence, encourage an unusually large number of faulty economic decisions — that is, encourage an unusually large number of economic decisions that are revealed only later to be mistaken. Specifically, injecting new money into the economy causes too many resources to be invested in those industries that first receive the new money. Those industries over-expand.

但我们在前一章讨论过,政府创造货币会带来严重的后果。向经济注入新货币的过程会扭曲相对价格并因此促成大量事后才能发现的错误经济决策。特别是新货币会使过多资源投资到那些新货币最先流经的行业。这些行业会过度扩张。

Trouble arises when the truth is revealed that these industries over-expanded. When this revelation occurs, investors and entrepreneurs begin to eliminate what they now see is excess capacity in these over-expanded industries. Efforts to shrink these over-expanded industries, though, inevitably cause hardships. Most notably, unemployment rises as workers are laid off from their jobs in these industries.

当人们发现这些行业过度夸张时,麻烦来了,投资者和企业家开始削减在这些行业的投入的资源。这些行业的萎缩不可避免地带来一段困难时期,尤其是这些行业裁员会导致失业率上升。

During the time that unemployment is unusually high — during the time that it takes for these laid-off workers to find new jobs — political pressure is intense for government to “do something” about this unemployment. One of the easiest “somethings” that government can do is to keep the inflation going. By continuing to inject new money into the economy, government can for a bit longer prop up prices in the industries that are among the first to get the new money. In short, by continuing to inflate the money supply, government can postpone the discovery by entrepreneurs and investors that the industries that are among the first to get the new money are in fact over-expanded and burdened with excess production capacity.

这段被裁工人重新找工作的时期,失业率常常高的不正常。因此政府面临着强烈的对失业率“做点什么”的政治压力。最简单的能做的“什么”就是政府可以继续维持通胀。通过继续向经济注入新货币,政府可以让那些最早获得新货币的行业的价格再多坚持一会。简单来说,政府可以通过继续增发货币制造通胀来推迟企业家和投资者发现那些最早获得新货币的行业其实已经产能过剩、过度扩张。

The benefit to politicians of continuing to inflate the money supply is that, by delaying the discovery of the need to scale back over-expanded industries, they keep the economy appearing for a while longer to be healthier than it really is. These politicians, therefore, are at less risk of losing their jobs in the next election.

政客继续制造通胀的好处在于通过推迟人们发现过度扩张的行业,他可以让经济的虚假健康再多维持一会。这样这些政客下次选举时连任的概率就大一点。

Economic reality, however, cannot forever be masked by the mere printing of more and more money. As the earlier streams of newly created money work their way through the economy to cause the prices of all goods and services to rise, inflation becomes expected. So for prices in the over- expanded industries to continue to be read by investors and entrepreneurs as signals that the increased investments in these industries are really not excessive, prices in these industries must rise even faster than before. Prices in these industries must rise at a pace greater than the expected rate of inflation.

但经济现实不可能仅仅靠不断印钱就掩盖住。当早期的新货币流遍经济体时,人们就会开始预期通胀的到来。所以想让过度扩张的行业的虚假繁荣不被投资者和企业家看出来,这些行业的产品价格必须比之前上升的还快——至少得比人们预期的通胀率快。

To cause prices in these industries to rise faster than the economy’s general rate of inflation, the central bank must quicken the pace at which it injects new money into the economy. If the central bank does so, prices in the industries that are first in line to get newly created money will remain higher than they “should” be relative to prices in other industries. Entrepreneurs and investors might then continue for the time being to believe that their increased investments in these “first-in-line” industries are justified. Efforts to scale back these industries are postponed. The unemployment rate, which would have risen today had there been no increase in the rate of monetary expansion, remains low. All looks well — for the present.

要让这些行业的价格涨得比通胀率还快,央行必须更频繁地向经济注入货币。如果央行真这么做,那最先得到新货币的行业相对其他行业的价格会继续维持在比它们“该有”的价格更高的地方。企业家和投资者可能会继续认为他们之前在这些“排在前面”的行业增加的投资是合理的。这些过热行业的回调被推迟了。本该现在上升的失业率被货币扩张抑制了,仍然走低。一切看着都挺好——就现在来说。

Eventually, however, the faster rate of money injection inevitably results in a faster rate of economy-wide inflation. Prices throughout the economy are now rising at a pace to catch up with the rising prices in those industries that are among the first to receive the newly created money. As a consequence, prices in these “first-in-line” industries stop sending out misinformation. These prices begin to reveal the fact that investments in these industries are indeed excessive — that productive capacity in these industries is too large. And so the only way the monetary authority can prevent investors from scaling back these industries and from laying off workers is to ramp up even more the rate of monetary expansion.

但最终更快的货币注入不可避免地导致更快的全面通胀。所有的价格都在上涨以追上最早获得新货币的行业的价格上涨速度。结果之一就是这些“排在前面”的行业不再发出错误的信号了。它们的价格开始显示出这些行业确实过热,也就是产能过剩了。所以货币当局阻止投资者撤出这些行业和裁人的唯一办法就是更激进的货币扩张。

The monetary authority soon finds itself in a difficult spot. If it stops inflating the money supply (indeed, even if it simply fails to accelerate the rate of growth in the money supply), the industries that over-expanded because of earlier injections of new money will contract. The resulting rise in unemployment creates political pressures for government to “do something” to raise employment — something other than counseling the public to patiently wait while industries are restructured to be more economically sustainable. Accelerating the rate of inflation is one maneuver the government can take to keep employment high for the present.

很快货币当局就会意识到自己的困难处境。如果它停止扩大货币供应(甚至只是没能加速扩大货币供应),那些由先前新货币注入导致过度扩张的行业就会萎缩。随之而来的失业率上升会给政府带来“做些什么”以拯救就业的政治压力,这个“什么”可不能是劝告公众耐心等待行业重组直至经济更加稳定。加速地制造通胀是能让政府维持当前就业率的权宜之计。

But the increasing rate of monetary expansion leads to an increasing rate of inflation, which causes a host of other economic ills. These other ills include rising interest rates. (Bankers and other lenders will charge higher interest rates because they expect to be repaid next year in money of lower purchasing power than is the money they lend out today.) The other ills also include greater anxiety among workers that their wages will not keep pace with inflation — so workers demand higher wages today, ahead of the expected higher inflation. (The danger here is that if the rate of inflation turns out to be less than expected, workers’ wages will have risen too high, causing some workers to lose their jobs or some employers to suffer unexpected losses.)

但是加速的货币扩张导致通胀加速,这带来大量经济上的恶果。恶果之一是利率上升(银行和其他债权人会收取更高的利率因为他们预期明年货币的购买力会不如现在)。另一个恶果是工人因为担心工资涨幅追不上通胀,会现在就要求加薪,以应对将要来临的高速通胀。(这里的危险在于假如最终通胀率低于预期,工人的工资就涨过头了,导致一些工人失业或者一些雇主蒙受意外损失。)

More generally, because monetary expansion does not cause all prices to rise in lock-step with each other, the higher the rate of inflation, the more distorted becomes the pattern of relative prices throughout the economy. The more out of whack individual prices become relative to each other, the less reliably do these prices guide entrepreneurs, investors, and consumers to make correct economic decisions. Higher rates of inflation, therefore, result in greater misuse (greater “misallocation”) of resources. The economy’s performance becomes worse and worse.

更一般地,因为货币扩张并不会让所有价格同步上涨,所以通胀率越高,整个经济体的相对价格扭曲的就越厉害。某个价格相对其他价格扭曲的越厉害,它就越不能可靠地指导企业家、投资者和消费者做出正确的经济决策。因此通胀率越高,资源错配得就越严重。经济表现得越来越差。

To cure this problem the monetary authority need only to stop injecting new money into the economy. But the cure isn’t instantaneous. Not only does it take some time for people to stop expecting future inflation, but, also, it takes time for workers and resources to shift away from industries that over-expanded because of inflation and toward industries where these workers and resources will be more sustainably employed. By continuing inflation today, the monetary authority might be able to delay just a bit longer the need for over-expanded industries to shrink, but doing so also causes inflation throughout the economy to worsen.

要解决问题,货币当局必须停止向经济注入新货币,但这并不会立竿见影。不仅打消人们对未来通胀的预期需要时间,把工人和资源从过度扩张的行业转移到更能长期利用它们的行业也需要时间。通过持续制造通胀,货币当局可能可以把过度扩张的行业的萎缩稍稍推迟,但这也会让整个经济的通胀越来越糟。

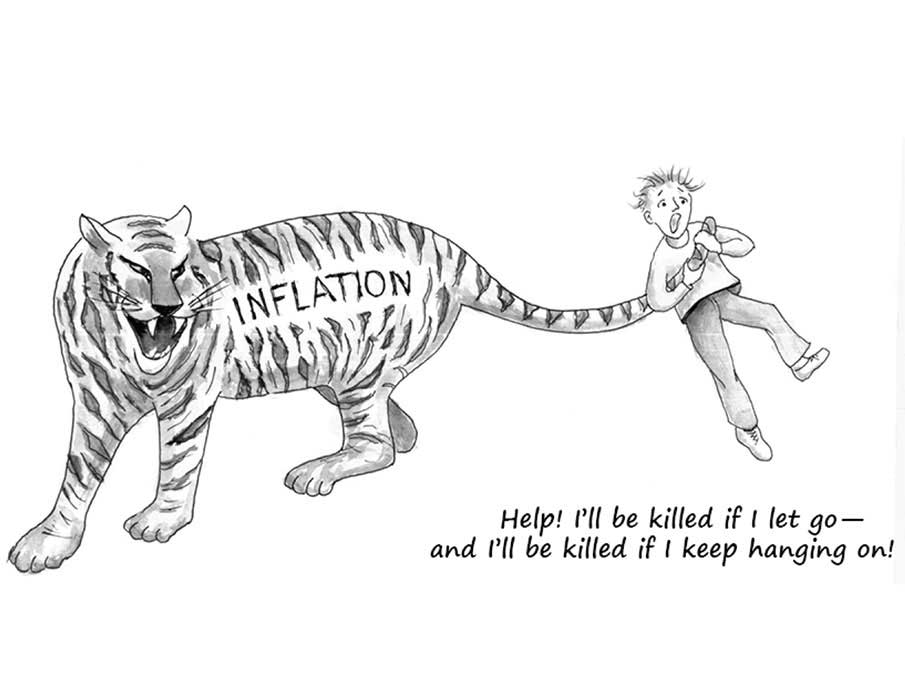

Politically, the monetary authority might be thought of as having grabbed (as Hayek described it) a “tiger by the tail.” While everyone agrees that a tiger ought never be grabbed by its tail in the first place, once someone does grab a tiger’s tail, that person is at risk of being bitten and clawed when he lets go. But by holding on to the tiger’s tail, he can delay facing the risk of being bitten and clawed. Holding on, though, only makes the tiger angrier, so that when it finally does break free — as it eventually will — the beast is even more likely to attack, and to attack with greater fury, the person who held its tail.

从政治上说,按哈耶克的说法,我们可以把货币当局理解为抓住了“老虎的尾巴”。大家都同意一开始就不该去抓老虎的尾巴,但一旦有人抓了,那放开的话就得冒被老虎撕咬的风险。虽然继续抓着可以让他晚点面对被撕咬的风险,但也会让老虎越来越生气,所以当最终放开时(这是一定会发生的),老虎更可能更加狂暴地进行攻击。

Understandably, at each moment in time, the person holding a tiger by the tail is tempted to hold on just a bit longer to delay the risk of being mauled by a big angry cat. Every moment of delay in letting go, however, only worsens the danger that will likely befall the person when he eventually does let go. And to make matters worse, at some point the tiger will become so furious that it will manage to break free on its own. The danger to the person who held on to the tiger’s tail for that long will be enormous.

可以理解,在任何时刻,那个抓着老虎尾巴的人都想再多抓一会来推迟被一只愤怒的大猫撕咬的危险。但每一次推迟都只会加剧最终松手时的危险。更糟的是,到了某个时刻老虎会变得太过狂怒而自己挣脱出来。把抓着这么长时间尾巴的人将会面临极大的危险。

The difficulty of stopping inflation is very much like the difficulty of letting go of a tiger’s tail. The mechanics of doing either task are incredibly easy: just stop printing money (to stop inflation) or relax the muscles in your hand (if you’re holding a tiger by the tail). Yet in light of the anticipated consequences of stopping inflation or of releasing a tiger’s tail, the task in either case is indeed challenging. In both cases performing the task requires not only the wisdom to see that continuing the current course will only make matters worse, but requires also the courage to confront the danger as soon as possible instead of delaying that confrontation. Unfortunately — and here the analogy with holding a tiger by the tail breaks down — by continuing the growth of the money supply, many people in political power today can themselves personally escape any resulting political dangers. The bad effects of more inflation today won’t materialize until sometime in the future, when many of today’s officials will be out of office. So officials in office today can, by keeping the money supply growing, make the economy appear to be healthier than it really is, while the costs of creating this illusion will be borne only in the future by mostly different officials.

停止通胀的难处和放开老虎尾巴的难处类似。二者的做法都很简单:停止印钞票(以停止通胀)或者松手(如果你正握着老虎的尾巴)。但考虑到这么做的后果,两种情况的做法其实又都很难,不仅要有预见到目前趋势若不改变情况只会不断恶化的智慧,还要有敢于选择尽快面对危险而不是不断推迟的勇气。不幸的是,停止通胀与抓老虎尾巴的比喻有一点不同,通过持续进行货币扩张,许多现在的政治人物可以逃脱最终的政治风险。今天通胀的恶果要在将来才会显现,而那时候很多今天的官员都已经平安退出政坛了。所以现在掌权的官员可以通过持续的货币扩张让经济显得比真实情况健康,同时把这个幻象的成本交给未来的官员承担。

This political bias in favour of inflation is the chief reason justifying arrangements that strictly regulate changes in the supply of money. Returning to the gold standard is one option. Alternatively, the economist Milton Friedman (1912-2006) famously proposed a “monetary rule” that would prohibit central banks from expanding the money supply beyond some very small amount (say, by no more than three percent annually). Hayek himself came to favour denationalization of money — that is, getting government completely out of the business of issuing money and controlling the money supply. Competitive market forces would instead be responsible for supplying sound money. (Friedman himself, just before he died, became so skeptical of central banks that he argued that government be stripped of any power and responsibility to regulate the supply of money.) Whatever the particular method used to eliminate political discretion over the money supply, eliminating such discretion should be among the highest priorities for those who seek an economy geared to solid, sustainable, and widespread economic growth.

政治上的这种对通胀的偏爱是应该对货币供应进行严格规范的正当理由。重回金本位是一个选项。或者采用米尔顿·弗里德曼(1912-2006)提议的著名的“货币规则”:只允许央行以某个很小的额度扩张货币(比如每年不超过3%)。哈耶克个人更青睐货币的非国家化,即货币发行和货币供应的控制完全不让政府插手。相互竞争的市场力量会负起供应稳健货币的责任。(弗里德曼本人在临死前也变得对央行极度怀疑,并主张应该彻底剥夺政府控制货币供应的所有权力和责任)不管具体用那种办法来消除货币供应上政府的自由裁量权,这件事都应该是追求稳定、持久、广泛繁荣的经济的人的优先目标。

Just as recovering alcoholics are wisely advised to avoid alcohol completely — and just as thrill seekers are wisely advised never to grab the tails of tigers — a people are wisely advised never to allow their government to exercise discretion over the supply of money. Following such a rule is the only sure way to avoid inflation and the many ills that it inflicts on an economy.

就像建议戒酒者彻底回避酒精是明智的一样,就像我们会明智地建议寻求刺激的人永远不要去抓老虎尾巴,我们也应该明智地建议人们永远不要允许他们的政府在货币供应上行使自由裁量权。只有这样才能避免通胀和相应的诸多经济恶果。